pfr-taler.ru Tools

Tools

Ukg Market Cap

Market Cap: $T. %. 24h Vol: $B. %. Cryptocurrencies UKG. This is a preview page. For more details on listing tiers, refer to Listings. Kronos along with its distributors and agents market and provide technical services for its products. Stock Name, Country, Market Cap, PE Ratio. Air Liquide. UKG is an American multinational technology company with dual headquarters in Lowell, Massachusetts, and Weston, Florida. $1B. Market Cap / Employee. UKG Unikoin Gold. UKG Price. $ +%. Market Cap. $M. 24H Volume. $K. Circ Supply. M. Sectors GamblingGamingToken BlockchainEthereum. Kronos along with its distributors and agents market and provide technical services for its products. Stock Name, Country, Market Cap, PE Ratio. Air Liquide. Market Cap. 1,,, Annualized Dividend. $ Ex Dividend Date. Sep 6, Dividend Pay Date. Sep 19, Current Yield. %. Information Key. Market Cap, 5 Years Return %, PE Ratio, Profit Margin. Kronos Worldwide Inc. Sell. $B. %. %. UKG Financial Summary · $B · $B · $B. Market Cap: $T. %. 24h Vol: $B. %. Cryptocurrencies UKG. This is a preview page. For more details on listing tiers, refer to Listings. Kronos along with its distributors and agents market and provide technical services for its products. Stock Name, Country, Market Cap, PE Ratio. Air Liquide. UKG is an American multinational technology company with dual headquarters in Lowell, Massachusetts, and Weston, Florida. $1B. Market Cap / Employee. UKG Unikoin Gold. UKG Price. $ +%. Market Cap. $M. 24H Volume. $K. Circ Supply. M. Sectors GamblingGamingToken BlockchainEthereum. Kronos along with its distributors and agents market and provide technical services for its products. Stock Name, Country, Market Cap, PE Ratio. Air Liquide. Market Cap. 1,,, Annualized Dividend. $ Ex Dividend Date. Sep 6, Dividend Pay Date. Sep 19, Current Yield. %. Information Key. Market Cap, 5 Years Return %, PE Ratio, Profit Margin. Kronos Worldwide Inc. Sell. $B. %. %. UKG Financial Summary · $B · $B · $B.

Unikrn price today is $ with a hour trading volume of $ , market cap of $ 21,, and market dominance of %. The UKG price increased. Follow Unikoin Gold price in real-time, UKG price history chart and others information. Market Cap. $ M. Volume (24H)?? UKG. Evaluating the financial viability of private companies is The 7 companies included in the index have a total market capitalization of over $B. UKG Pairs ; E-6, Kucoin, 0, /cdn/crypto/logos/exchanges/pfr-taler.ru, BTC ; E-5, Upbit, 0, /cdn/crypto/logos/exchanges/pfr-taler.ru, ETH Mkt Cap M. Industry Specialty Chemicals. Statistics: KRO. View More. Valuation Measures. Current Quarterly Annual. As of 9/9/ Market Cap. B. Equity Holdings · Price/Earnings · Price/Book · Price/Sales · Price/Cashflow · Median Market Cap · 3 Year Earnings Growth. Workday's brand is ranked # in the list of Global Top Brands, as rated by customers of Workday. Their current market cap is $B. /5. Markets Gold and Silver International Dividend US Dividend US Energy US High Dividend US Large Cap UKG Inc (US:USKAK79) has 0 institutional owners. The current price of UnikoinGold is $ per UKG. With a circulating supply of 0 UKG, it means that UnikoinGold has a total market cap of $ Get the live Unikoin Gold price today is $ USD. UKG to USD price chart, predication, trading pairs, market cap & latest Unikoin Gold news. Market Cap: B. Shares Outstanding: 31,, Revenue: B. Net Income: . EPS UKG Inc. develops and offers cloud-based human capital management and. UKG Pro has market share of % in human-capital-management market. UKG Pro competes with 61 competitor tools in human-capital-management category. The top. Available deals in UKG and all other companies; Deal offering documents; EquityZen's proprietary data and insights, including. Cap tables, which include funding. UKG price has plummeted by % in the last day, and decreased by % in the last 7 days. It's important to note that current Unikoin Gold market. Unikrn price today is $ UKG price changed % in the last 24 hours. Get up to date Unikrn charts, market cap, volume, and more. Get the latest and historical Unikoin Gold price, UKG market cap, trading pairs, and exchanges. Check the charts, UKG to USD calculator. Unikoin Gold (UKG) is the # largest cryptocurrency by market cap as of August 22, , with a market cap of $1,, USD. How Much Did Unikoin Gold. Unikoin Gold Price Today US - Check the latest Unikoin Gold price, UKG live chart, market cap, trading volume, latest Unikoin Gold news, total circulating. UHNKAU KING Coin price is $ UKG's market cap is $23K and its 24h trading volume is $0. Get real-time crypto data now! Market Cap: $ billion. Optionable: Optionable. Beta: 10 Best Stocks to Own in Cover. 10 Best Stocks to Own in Click the link below and we'.

Digital Media Facts

Social Media Statistics Details · There are billion social media users worldwide, representing % of the global population and % of all internet. Social media refers to the means of interactions among people in which they create, share, and/or exchange information and ideas in virtual communities and. billion people around the world now use social media, million new users have come online within the last year. The average daily time spent using. Comscore's solutions for digital media publishers provide third-party measurement of all digital activity of your properties across desktop and mobile. Examples of Electronic media are things such as the television the radio, or the wide internet. What is the purpose of using Electronic media? The purpose of. By examining the digital media startups and publications that participated in the Digital Facts & Frictions: Emerging Debates, Pedagogies and Practices in. There were billion social media users around the world at the start of July , equating to percent of the total global population. Digital Media Literacy; Digital Issues. Digital Issues. thumb social media, the Internet is a never-ending source of information. But how. Like traditional media, digital media are tools used for communication, including not only one-way dissemination of information as in the past, but. Social Media Statistics Details · There are billion social media users worldwide, representing % of the global population and % of all internet. Social media refers to the means of interactions among people in which they create, share, and/or exchange information and ideas in virtual communities and. billion people around the world now use social media, million new users have come online within the last year. The average daily time spent using. Comscore's solutions for digital media publishers provide third-party measurement of all digital activity of your properties across desktop and mobile. Examples of Electronic media are things such as the television the radio, or the wide internet. What is the purpose of using Electronic media? The purpose of. By examining the digital media startups and publications that participated in the Digital Facts & Frictions: Emerging Debates, Pedagogies and Practices in. There were billion social media users around the world at the start of July , equating to percent of the total global population. Digital Media Literacy; Digital Issues. Digital Issues. thumb social media, the Internet is a never-ending source of information. But how. Like traditional media, digital media are tools used for communication, including not only one-way dissemination of information as in the past, but.

Information can come from many different sources and perspectives. But when you're only hearing the same perspectives and opinions over and over again, you may. CTRL-F is a digital media literacy program that helps students evaluate online sources and claims to determine what to trust. Social media is a collective term for websites and applications that focus on communication, community-based input, interaction, content-sharing and. Social media ads receive the largest portion of global mobile advertising investment, with marketers spending over $ billion on mobile social media. Worldwide, people spend an average of 2 hours and 28 minutes per day on social media, and over 75% of the world's population aged 13+ uses social media. Bookmark the report to reference key internet and social media statistics. Insights such as the most widely used social media networks, how often people spend. Digital media designers work in a variety of mediums. You could be doing storyboards for movies, background layouts for Saturday morning cartoons, or full. That's equal to percent of all the people on Earth, and suggests that percent of internet users now use social media every month. The number of active. 71% use social media. Almost three-quarters of adults with Internet access also have at least one social media account, and 52% of online adults use two or. Although social media companies typically publish privacy policies, these policies are wholly inadequate to protect users' sensitive information. Privacy. Social media, communications on the Internet (such as on websites for social networking and microblogging) through which users share information, ideas. Digital Media. The Digital Media specialization is intended for journalists and other media or communication specialists who wish to retool and gain. The Digital Communication, Information and Media (DCIM) minor complements every major across the Rutgers academic spectrum and provides you with the ability to. The Source of Truth, Stats and Information Here's our free 3-step plan and insights for activating players as social marketers — with the digital media you. Australian Social Media Advertising Statistics. Australian digital advertising grew by % in the year to January to be USD B. (Source,). Australia. The Internet has helped blur the line between fact and opinion in the media. Now there are virtually limitless sources out there creating content online. Engagement through digital media is an effective way to reach your audiences. These resources provide key information for campus partners on methods and. Digital media connects people. It can be used to educate the public about the government's work and services, promote cooperation across government. This blog post has all the latest stats on Facebook, YouTube, Instagram, TikTok, X (Twitter), and LinkedIn. It also includes stats on Pinterest, Snapchat, and. Before social media's entry into the digital era, traditional media and the government were the only sources of information. However, this has now changed for.

Things To Know When Selling A House

What happens when you list your home for sale? How To Sell Your HouseWhat happens when you list? What to know when choosing an agent to sell your home. How. 1. Figure out what your home is worth If you're thinking about selling your house after one year or less, you first need to determine your home's fair market. Be flexible with showings. Allow all showings. Even last minute. Keep house spotless for one week minimum. Stay in hotel if it's easier. I know you think you don't, but when it's time to start prepping your house for sale and clearing all your clutter, you'll realize just how much has accumulated. We'll go through each of the costs you'll face in more detail, but in brief you'll have to consider the following: estate agents, legal fees, energy performance. What are the costs associated with selling a house? · Home repairs or renovations · Real estate fees · Home staging · Photography and advertising · Auction fees. 1. Repair receipts - This just gives the buyer a history to work with. They know who has done work in the past and is familiar with the property. Important Steps in Your Home Selling Journey · Learn the market and determine your home's value: Do a little research so you're familiar with your market; it. When buyers are looking at a home, they scrutinize the details. Do light fixtures work? What about appliances and doors? Are the windows clean? Paying attention. What happens when you list your home for sale? How To Sell Your HouseWhat happens when you list? What to know when choosing an agent to sell your home. How. 1. Figure out what your home is worth If you're thinking about selling your house after one year or less, you first need to determine your home's fair market. Be flexible with showings. Allow all showings. Even last minute. Keep house spotless for one week minimum. Stay in hotel if it's easier. I know you think you don't, but when it's time to start prepping your house for sale and clearing all your clutter, you'll realize just how much has accumulated. We'll go through each of the costs you'll face in more detail, but in brief you'll have to consider the following: estate agents, legal fees, energy performance. What are the costs associated with selling a house? · Home repairs or renovations · Real estate fees · Home staging · Photography and advertising · Auction fees. 1. Repair receipts - This just gives the buyer a history to work with. They know who has done work in the past and is familiar with the property. Important Steps in Your Home Selling Journey · Learn the market and determine your home's value: Do a little research so you're familiar with your market; it. When buyers are looking at a home, they scrutinize the details. Do light fixtures work? What about appliances and doors? Are the windows clean? Paying attention.

Realtor fees: The typical real estate agent's commission is % - 3% of the home's selling price, which means that the combined real estate agent fees for both. What are the costs associated with selling a house? · Home repairs or renovations · Real estate fees · Home staging · Photography and advertising · Auction fees. In This Article: · Will you sell by owner or use an agent? · Learn the market. · Prepare your property to sell. · Price your home to sell. · Create a listing. Here's a look at all the hidden costs of selling a house, including agents fees (which may be changing soon), repairs, staging and closing costs. Choose a Listing Agent · Make Necessary Repairs and Updates · Climate Change May Impact Home Values · Determine the Asking Price · Stage Your Home. What works · Clean, bright and airy residences · Neutral colours · Well-landscaped gardens · Plenty of outdoor living space such as decks and covered patios · Soft. Confirm that they're familiar with selling your property type, whether it be a single-family, condo, or townhouse. Check for an agent's designations in a. 12 Tips for selling your home · 1. Declutter – but don't depersonalise. Get rid of items that have accumulated. · 2. A fresh lick of paint · 3. Maximise kerb. Check Zillow Offers to consider a quick, convenient sale. If the biggest thing holding you back from selling your home is the time and effort required to do. First, the accepted offer must get to the buyer's mortgage originator. Both the buying and selling sides must have a fully executed contract to be legal and. Opendoor is the new way to sell your home. Skip the hassle of listing, showings and months of stress, and close on your own timeline. 1. Decide if you should sell · 2. Figure out your finances · 3. Decide if you should rent a house next, rather than buy · 4. Choose an estate agent to sell your. We'll share what month is best to list, but only you know when the time is right for you. When Is the Best Time to Sell A House? Nationally, the best time to. The hardest part about buying a new house before selling the old one is the financial requirements. Go over your finances and determine your home buying budget. When selling a property in New Jersey, there is a legally implied warranty that the property is habitable or, in other words, that the home is fit to live in. It often makes sense to sell your current home before buying your next home. Most homeowners need the equity from their current home to make a down payment on. Unlike winter, spring and summer offer beautiful weather that allows sellers to showcase their home's exteriors. This is a time when curb appeal is majorly. Consider hiring a real estate agent, photographer, and staging company. Be prepared to have flexibility on sale terms and conditions. Should I Hire. What are the things one should keep in mind before selling a Property in India? · Verify Property Documents: The first and most important step is to verify all.

Securities Backed Lending

How Securities Based Lending, Structured Lending and Margin accounts measure up to your borrowing needs. Raymond James Bank understands that having access to. Securities lending is the market practice where securities are transferred temporarily from a securities lender to a securities borrower for a fee. With a securities-based line of credit, Fidelity makes it simple to use your accounts as collateral to access cash for real estate, tuition or other major. The Margin Lending Program (margin) provides an extension of credit based on eligible securities used as collateral from your qualified Merrill accounts. Securities-based lending provides ready access to capital. From purchasing a property, buying assets, investing in stocks or growing a business, you can use. Citibank, N.A. offers these loans, on a discretionary basis, as part of its overall relationship with the client. The value of the margin loan collateral is. Marketable securities financing can be approved against a variety of assets. You can borrow against them up to a certain percentage of their market value. The. Details of a Securities-Backed Loan · Loans available from $75, to $,, · Up to 85% LTV on Investment Grade Bonds · Up to 80% on Public Equities and. Securities Backed Lending (SBL) is a solution that can give you access to funds by using your existing cash and investments with Barclays Private Bank as. How Securities Based Lending, Structured Lending and Margin accounts measure up to your borrowing needs. Raymond James Bank understands that having access to. Securities lending is the market practice where securities are transferred temporarily from a securities lender to a securities borrower for a fee. With a securities-based line of credit, Fidelity makes it simple to use your accounts as collateral to access cash for real estate, tuition or other major. The Margin Lending Program (margin) provides an extension of credit based on eligible securities used as collateral from your qualified Merrill accounts. Securities-based lending provides ready access to capital. From purchasing a property, buying assets, investing in stocks or growing a business, you can use. Citibank, N.A. offers these loans, on a discretionary basis, as part of its overall relationship with the client. The value of the margin loan collateral is. Marketable securities financing can be approved against a variety of assets. You can borrow against them up to a certain percentage of their market value. The. Details of a Securities-Backed Loan · Loans available from $75, to $,, · Up to 85% LTV on Investment Grade Bonds · Up to 80% on Public Equities and. Securities Backed Lending (SBL) is a solution that can give you access to funds by using your existing cash and investments with Barclays Private Bank as.

Any loan extended under a securities-based line of credit is subject to credit approval by Chase Bank and, if approved, the terms and conditions contained in. A ready source of credit using your securities as collateral. · Less expensive: Since SBLs are secured by your securities, interest rates are typically lower. Securities Based Lending involves obtaining a loan or line of credit secured by assets in a client's Baird account (each an “Account”). Eligible. Baird clients. An extension of credit based on eligible securities you pledge as collateral from qualified Merrill brokerage accounts. Learn more. Securities-based lending refers to the practice of using non-retirement, marketable securities such as stocks, bonds and mutual funds as collateral for a line. Generate incremental return from your long assets through our global agency lending platform; our technology allows you to tailor parameters giving you control. What it is: Similar to margin, a securities-based line of credit offered through a bank allows you to borrow against the value of your portfolio, usually at. The Nationwide Smart Credit securities-backed line of credit can help solve the liquidity needs of a client. This cost-effective solution delivers access to. The loan is customised around your repayment, amount, time frame and collateral structures. X. Funds arranged with minimal paperwork. A full credit review of. However, there are also some key differences between the two. Securities-based lending is typically a non-purpose loan, meaning the funds can be used for any. Flexible enough to meet almost any personal or business financing need, our Securities Based Line of Credit (SBL) is collateralized by securities within your. Read about three asset-backed lending solutions—HELOC, margin, and securities-based lines of credit—and under what circumstances you might consider using. How Does Securities-Backed Lending Work? Securities-backed lending is relatively straightforward. Your securities are pledged to the lender, or alternatively. The instrument through which you tap the value of your securities is called a securities-based line of credit (SBLOC), which allows you to borrow money and make. Securities-Backed Line of Credit (SBLOC) · An SBLOC offers your clients timely access to an interest-only revolving credit line based on portfolio value. A securities-backed loan may be used for a variety of needs, including real estate investments, bridge loans, personal expenses, business expansion, higher. For investors, businesses, and private clients, securities-based lending allows clients to finance virtually any need while maintaining a long-term. What is Securities based Lending. Definition: Security-based lending is the practice of raising a loan by offering your existing investments in stocks/mutual. ¹Securities-based lending is a non-purpose margin loan secured by eligible, marketable securities. It is non-purpose because the proceeds of the line of credit. Securities-backed lending is granted on an individual basis, and as a result, there's no standard interest rate; however, current rates range from 2%-6%.

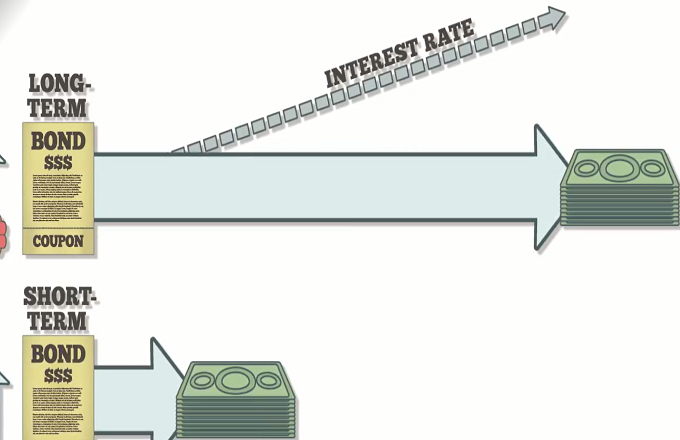

Short Term Vs Long Term Bonds

The time from when the bond is issued to when the borrower has agreed to pay the loan back is called its 'term to maturity'. There are government bonds (where a. Short-term bonds mature in one to three years, while long-term bonds won't mature for more than a decade. Generally, the interest on municipal bonds is exempt. Short term bonds having higher yields than long term bonds is the present state but historically that hasn't been true more often than not. Short-term interest rates apply to borrowing that is conducted within one year. Long-term interest rates apply to money that is borrowed for longer than one. Duration measures the linear relationship between bond prices and yield-to-maturity. Convexity is a second-order effect describing a bond's price behavior for. The best time to buy bonds is when rates are high, like in Even when rates are a bit higher, mid term bonds are usually the sweet spot, as far as rates. Bonds are long-term securities that mature in 20 or 30 years. Notes are relatively short or medium-term securities that mature in 2, 3, 5, 7, or 10 years. Both. And one reason for that is that long-term interest rates generally embody two factors. One is the expected average value of short rates over, say, 10 years, and. Because bonds with shorter maturities return investors' principal more quickly than long-term bonds do. Therefore, they carry less long-term risk because the. The time from when the bond is issued to when the borrower has agreed to pay the loan back is called its 'term to maturity'. There are government bonds (where a. Short-term bonds mature in one to three years, while long-term bonds won't mature for more than a decade. Generally, the interest on municipal bonds is exempt. Short term bonds having higher yields than long term bonds is the present state but historically that hasn't been true more often than not. Short-term interest rates apply to borrowing that is conducted within one year. Long-term interest rates apply to money that is borrowed for longer than one. Duration measures the linear relationship between bond prices and yield-to-maturity. Convexity is a second-order effect describing a bond's price behavior for. The best time to buy bonds is when rates are high, like in Even when rates are a bit higher, mid term bonds are usually the sweet spot, as far as rates. Bonds are long-term securities that mature in 20 or 30 years. Notes are relatively short or medium-term securities that mature in 2, 3, 5, 7, or 10 years. Both. And one reason for that is that long-term interest rates generally embody two factors. One is the expected average value of short rates over, say, 10 years, and. Because bonds with shorter maturities return investors' principal more quickly than long-term bonds do. Therefore, they carry less long-term risk because the.

Short-term investors are investors who invest in financial instruments intended to be held in an investment portfolio for less than one fiscal year. And one reason for that is that long-term interest rates generally embody two factors. One is the expected average value of short rates over, say, 10 years, and. Short-term bond portfolios invest primarily in corporate and other investment-grade US fixed-income issues and have durations of one to years. Bonds and bond strategies with longer durations tend to be more sensitive and long term, especially during periods of downturn in the market. PIMCO. All else being equal, a bond with a longer maturity usually will pay a higher interest rate than a shorter-term bond. For example, year Treasury bonds. While bonds may not fare as well as cash if you're early, we show that bond returns are comparable to cash in the short term, and the ensuing easing cycle more. Medium- or intermediate-term bonds are generally those that mature in four to 10 years, and long-term bonds are those with maturities greater than 10 years. The downside of long-term bonds is that you lack the flexibility that a short-term bond offers. If interest rates rise, for instance, the value of a long-term. What this assumption means is that many participants in the bond market are indifferent between short-term and long-term bonds. Investors will invest. These bonds are considered to be low-risk investments because they are backed by the full faith and credit of the government issuing them. Short-term government. A yield curve is a comparison between long-term and short-term bonds that depicts the relationship between their rates of interest. Short-term investors are investors who invest in financial instruments intended to be held in an investment portfolio for less than one fiscal year. In an environment where short-term yields are the same or higher than long-term yields, many investors are replacing traditional bond investments with cash. The time from when the bond is issued to when the borrower has agreed to pay the loan back is called its 'term to maturity'. There are government bonds (where a. The long-term investment account differs from the short-term investment account in that short-term investments will most likely be sold after a short period of. Long term bonds are very risky because interest rates are so low, when inflation returns and interest rates rise, those long bonds will get crushed! In other words, an issuer will pay a higher interest rate for a long-term bond. An investor therefore will potentially earn greater returns on longer-term bonds. Meanwhile, short-term investors may want to avoid volatile investments, such as some riskier stocks or stock mutual funds. Risk Tolerance. Risk tolerance is the. In other words, an issuer will pay a higher interest rate for a long-term bond. An investor therefore will potentially earn greater returns on longer-term bonds. So, long-term maturity bonds will generally offer greater interest rates (or yields) to compensate for the greater risk to principal. At the other end, short-.